B Notice – The IRS Just Sent Me A 2100 Notice. What Now?

“Uh-oh.” You say to yourself as you are shuffling through the daily mail—a notice from the Internal Revenue Service (IRS). You haven’t even opened the letter, but a blanket of fear drapes over you. “Did they find errors on my tax return? Will I owe tax and penalties? Am I being audited?!”

Whew! It’s just a 2100 Notice. These notices appear to be for informational purposes, but they can create an administrative headache for Form 1099 filers.

If ignored, this notice creates potential backup withholding exposure, filing penalties, and possibly an IRS Form 1099 audit.

What is a 2100 Notice?

A 2100 Notice is sent to companies with errors on the Form 1099s they submit to the IRS.

If you get a 2100 Notice from the Internal Revenue Service, don’t panic. The letter isn’t sent because you did anything wrong. Unless, of course, you keyed the incorrect information from a Form W-9, Request for Taxpayer Identification Number and Certification, into your system.

The likely reason for the notice is one of your vendors submitted a Form W-9 with mismatching name and taxpayer identification number (TIN).

In turn, you sent them a Form 1099 with information that doesn’t match the IRS’s database. The IRS sends you a notice to inform you of the discrepancy.

What is a B Notice?

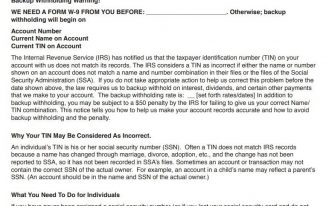

A B Notice is what you will send to your vendors. You’ll explain that the IRS notified you that the Taxpayer Identification Number (TIN) and name your vendor provided you on Form W-9 doesn’t match the IRS’s records.

This mismatch makes it difficult for the IRS to reconcile the income reported on Form 1099 to your vendor’s tax return. The IRS pushes it back on the providers of Form 1099 to ensure that names and TINs are correct.

First B Notice

There are two B Notices that are sent to the vendor.

The first B Notice is sent after you first receive a CP2100 Notice. You have 15 business days from the date of the notice or the date you received it, whichever is later, to send the B Notice. Include Form W-9 for the vendor to fill out and send back to you.

Although it is not required, you can also include a self-addressed stamped envelope to encourage them to respond. Include on the outside of your envelope “IMPORTANT TAX INFORMATION ENCLOSED.”

Source: IRS.gov

Second B Notice

The second notice is sent if you receive a second CP 2100 Notice for the same vendor within a three-calendar year period.

This time don’t include a Form W-9. Instruct the vendor to contact the IRS or SSA to find out the correct name/TIN combination.

The IRS has created Publication 1288, which includes templates for the two B Notices to send to your vendors.

If you receive a third 2100 Notice, you can ignore it if you have complied with the required actions for the first two notices.

However, if it is related to the same payee, but there is a different name/TIN combination, this is considered a first notice.

For example, if you received a corrected Form W-9 from your vendor with the first B Notice you sent, but the information is still wrong, you will receive a 2100 notice stating there is still an error. You will then have to start the process over again by sending out a first B notice to the vendor.

What is backup withholding?

Companies who file information returns with incorrect Taxpayer Identification Numbers (TINs) are instructed to begin backup withholding at a rate of 24%.

If the vendor responsible for you receiving the 2100 Notice does not respond within 30 days, or if the mail comes back undeliverable, you will need to begin backup withholding from future payments.

If the company responds with updated information, you have 30 days to stop backup withholding. To report backup withholding, use Form 945, Annual Return of Withheld Federal Income Tax.

This sounds like a lot of work. Any tips to make it easier?

Yes. You are required to send out two notices within a three-calendar year period. Keep track of any notices that you receive.

Make sure you write on the notice the date that you received it since you have 15 days to send out notices to those with a mismatch between their name and TIN. Since it is up to you to determine which notice is first and which is second, the dates make it easy to keep track. Make copies of the B Notices and dates you send them out.

Remember that you may be subject to penalties for failing to file a complete and accurate Form 1099. However, the IRS may waive penalties if you can show that your failure was due to reasonable cause and not willful neglect.

By keeping good records, you will be able to show that you received the Form W-9 in good faith, unknowingly reported incorrect information, then followed guidelines from the IRS to correct the mismatch.

Vendors often submit information they believe is correct. The Internal Revenue Service offers a free service to payers to validate TIN and name combinations. We recommend that you validate the information on a Form W-9 as soon as the vendor provides it. Doing so shows the IRS that you take Form 1099 reporting seriously and will put you in a strong position if you ever receive a notice