B Notice – The IRS Just Sent Me A 2100 Notice. What Now?

The notice means the IRS found a name and taxpayer identification number (TIN) mismatch or a missing TIN on one or more of your filed Forms 1099.This notice requires you to take corrective action under the IRS B Notice rules — part of the backup withholding process.

What Is an IRS CP 2100 Notice?

The IRS CP 2100 Notice (or the smaller CP 2100A) alerts you that information you submitted on certain 1099 forms doesn’t match the IRS or SSA database.

This can happen for a few reasons:

- The payee provided an incorrect or outdated Social Security Number or Employer Identification Number.

- The name on the Form W-9 doesn’t match the one registered with the IRS or SSA.

- The payee never provided a valid Form W-9.

When this occurs, the IRS requires you to follow its B Notice procedures to fix the issue and prevent penalties.

What Is a B Notice?

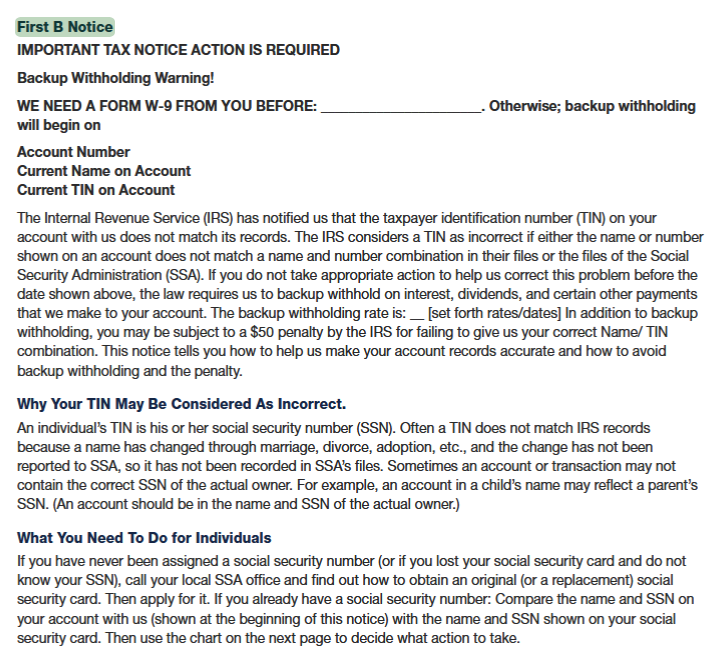

A B Notice (“Backup Withholding Notice”) is a letter you send to a payee whose name/TIN combination appears on your CP 2100 Notice.

It informs them that the IRS found a mismatch and tells them how to correct it.

There are two types of B Notices:

- First B Notice – Sent the first time the mismatch occurs within three calendar years.

- Second B Notice – Sent if the same payee appears again on a later CP 2100 Notice within three years.

Each has different requirements defined in IRS Publication 1281 (Rev. Oct 2023).

The First B Notice

When you receive a CP 2100 Notice for a payee for the first time in three years, you must send a First B Notice and include a blank Form W-9.

The payee must complete and return the Form W-9 so you can correct the information in your records.

If they don’t respond within 30 business days, you must begin backup withholding at 24 % on future reportable payments.

You must send the First B Notice within 15 business days after receiving your CP 2100 Notice.

For an editable version and mailing instructions, see our

First B Notice Sample and Template.

The Second B Notice

If the IRS sends another CP 2100 Notice for the same payee within three years, you must send a Second B Notice.

This one is more serious — you cannot accept another Form W-9.

The payee must instead verify their name and TIN directly with the IRS or SSA:

- Individuals: Contact the SSA for name/SSN verification.

- Businesses: Request IRS Letter 147C to confirm their EIN.

Backup withholding at 24 % must begin if you don’t receive verification within 30 days.

See the full example here:

Second B Notice Sample – Official Template.

What Is Backup Withholding?

Backup withholding is a federal withholding requirement applied when a payee fails to provide a correct TIN.

The current rate is 24 %, and the tax must be reported and remitted on Form 945 (Annual Return of Withheld Federal Income Tax).

You must start withholding if:

- The payee fails to return Form W-9 (First B Notice).

- The payee fails to provide official IRS/SSA verification (Second B Notice).

Continue withholding until you receive valid verification.

How to Respond to a CP 2100 Notice

- Review the notice and identify affected payees.

- Determine the correct B Notice (First or Second).

- Send the B Notice within 15 business days.

- Track responses and collect completed W-9s or IRS/SSA letters.

- Begin backup withholding if no response within 30 days.

- Keep records for at least four years.

How to Prevent Future CP 2100 Notices

You can reduce errors and avoid extra paperwork by following a few preventive steps:

- Use the IRS TIN Matching Program to verify vendor TINs before filing.

- Collect Form W-9s early — before you issue the first payment.

- Keep your vendor records updated with correct names and TINs.

- Re-validate recurring vendors annually.

- Educate your staff on proper 1099 and B Notice procedures.

Learn more in our B Notice Q&A.

Common Mistakes to Avoid

- Referring to Publication 1288 instead of the correct Publication 1281.

- Using the old 28 % withholding rate (instead of 24 %).

- Sending the B Notice after the 15-day window.

- Forgetting to include Form W-9 with the First B Notice.

- Accepting a new W-9 for a Second B Notice.

- Failing to retain proof of mailing and correspondence.

IRS References and Resources

- IRS Publication 1281 (PDF) – Backup Withholding for Missing and Incorrect Name/TINs

- Form 945 – Annual Return of Withheld Federal Income Tax

- First B Notice Sample

- Second B Notice Sample

- B Notice Q&A

Editor

25 years of experience managing tax, accounting, payroll, and employment-related information portals. Editor of Accounting Portal since 2011.

Read full bio →

Disclaimer

The information provided on Accounting Portal is for general informational and educational purposes only and does not constitute professional accounting, tax, financial, or legal advice.

While we strive for accuracy and timeliness, no representation or warranty is made regarding completeness or reliability. Always consult a qualified professional before making any business, tax, or financial decisions.

Neither Accounting Portal nor its authors are liable for any loss or damage resulting from the use of this information.

© 2026 Accounting Portal. All rights reserved.